In the absence of the Geneva International Motor Show, carmaker and consumer attention has shifted to Brussels. With a fresh international focus, many brands used the event to premiere upcoming models. Autovista24 journalist Tom Hooker reviews the main talking points from the Brussels Motor Show.

With 67 brands and many global premieres, the Brussels Motor Show’s presence on the international stage is growing. It also plays host to the Car of the Year award, one of the industry’s most well-recognised accolades.

Despite its increasing stature, the Brussels Motor Show remains close to its roots. Historically a sales-focused event, it carries a heavy importance for the Belgian new-car market. Additionally, plenty of commercial vehicles and motorbikes are on display. This domestic and international proposition makes it stand out as an automotive event.

Premieres at Brussels Motor Show

Kia showed off four models at the Brussels Motor Show. One of these was the EV2, a B-segment crossover SUV. Positioned as the brand’s smallest and most affordable battery-electric vehicle (BEV) in Europe. It has an estimated WLTP driving range of up to 448km and will offer bi-directional vehicle-to-load (V2L) charging.

Production of the BEV will begin in the first quarter of 2026, with the standard-range model. This will be followed by a long-range version and a ‘GT Line’ variant, with market launches due to be announced closer to the start of sales.

The manufacturer’s other three reveals also derived from its GT model range. This included the EV3 GT, EV4 Hatchback GT and EV5 GT. Production of these three models will start in the second half of 2026.

Meanwhile, Hyundai presented the world premiere of the Hyundai Staria Electric, a BEV multi-purpose vehicle (MPV) with an 800-volt architecture. It will go on sale in Europe and Korea in the first half of 2026.

The MPV was joined by the Concept Three, which was confirmed as the precursor to the Ioniq 3. The model will be a compact BEV designed and produced in Europe. Elsewhere, the updated Ioniq 6, a mid-size BEV sedan, made its first European motor show appearance.

Mazda’s new BEV

Mazda unveiled the CX-6e at the Brussels Motor Show, a crossover BEV SUV. Claiming a WLTP range of up to 300 miles (482km), it is scheduled to launch in the UK this summer. Mazda also premiered its new CX-5, the third generation of the brand’s best-selling model.

Elsewhere, the Toyota Hilux marked its European debut at the show. The ninth generation of the model will be offered for the first time as a BEV from April 2026.

It will also be available as a hybrid from July 2026, which Toyota claims will be the volume-selling model. Additionally, petrol and diesel versions will be offered in selected markets.

Meanwhile, Suzuki’s E-Vitara enjoyed its European premiere. The SUV is the carmaker’s first BEV, which it hopes will be a brand turning point. Meanwhile, Isuzu hosted the European premiere of the new D-Max pick-up, fitted with a newly developed diesel engine.

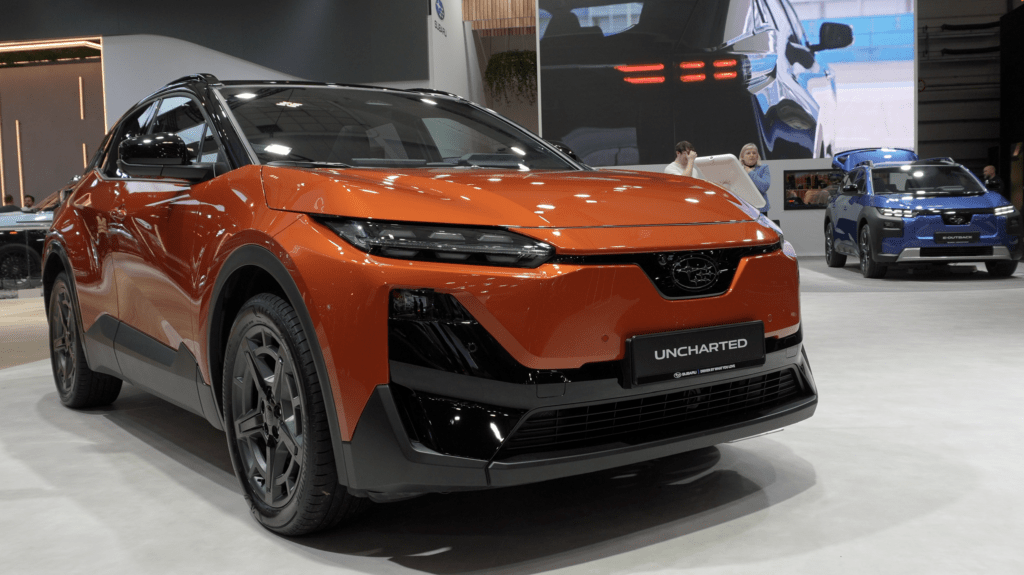

Subaru held the European premiere of the e-Outback and Uncharted. The latter is the brand’s first compact BEV SUV. It will be available in both all-wheel drive and front-wheel drive, with a range of up to 600km for the long-range version.

Chinese premieres at Brussels Motor Show

BYD showcased the Atto 2 DM-i at the Brussels Motor Show. The compact plug-in hybrid (PHEV) SUV offers a WLTP combined range of up to 1,000km. First deliveries of the model are expected early this year.

Leapmotor unveiled the B03X for the first time in Europe, a B-segment BEV SUV. It is the carmaker’s first model to be developed on a new global platform. It also showcased the B05, a C-segment hatchback, featuring a WLTP range of 460km.

The marque also expanded its B10 powertrain to include an extended-range electric vehicle (EREV), capable of a 900km combined range. SAIC-owned MG held the European Premiere of its S6. The electric C-segment SUV is available with a single or dual motor, offering a WLTP range of up to 301 miles (529km).

More market entrants

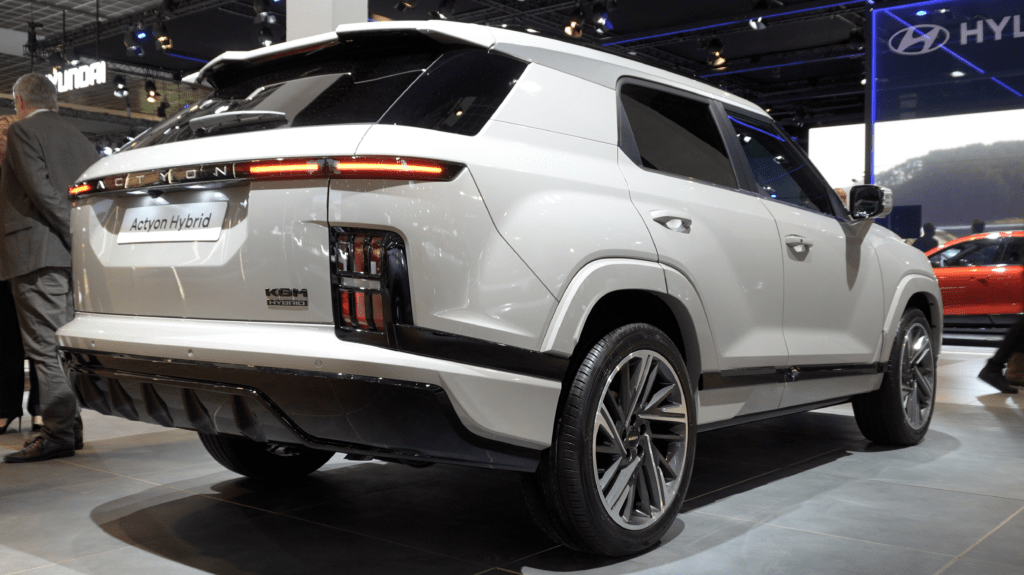

Also enjoying a European premiere was KGM’s Actyon Hybrid, a D-segment SUV. Xpeng also celebrated a continental debut with the P7+, the brand’s first AI-defined vehicle. The 800-volt BEV fastback with a WLTP range of 530km will be produced by Magna Steyr in Austria.

Zeekr arrived with the 7GT, a D-segment BEV. The station wagon boasts an electric range of up to 655km in the long-range rear-wheel drive version. Meanwhile, the all-wheel drive variant accelerates from 0-100kph in 3.3 seconds.

Nio used the Brussels Motor Show to announce its Belgian market entrance with the ET5 Touring and EL6 First Editions. Livan presented the X6 Pro, a petrol-powered SUV.

European premieres at Brussels Motor Show

Peugeot chose the Brussels Motor Show as the place to host the world premiere of the new 408. The C-segment sedan is available as a BEV, PHEV and mild hybrid. The all-electric version offers V2L capabilities and a WLTP range of 456km.

Fellow Stellantis brand Opel held a world premiere for the new generation of the Opel Astra and Astra Sports Tourer. The former will be available as a combustion engine, a hybrid, a PHEV and a BEV. The all-electric version of the Astra boasts a WLTP range of 454km.

Citroën’s centrepiece was the premiere of the ELO concept car. The model is built on an electric architecture and can seat up to six people. The interior can be turned into a sleeping space for two people, a home cinema, or a power supply.

DS Automobiles threw the covers off the N°4 Concept. The model was designed by the DS Design Studio and DS Penske Formula E Team driver Taylor Barnard.

Lancia used the Brussels Motor Show as a chance to outline the main projects behind the brand’s relaunch strategy. The carmaker has a particular focus on product and commercial development across European markets. Additionally, the Fiat 500 Hybrid made its international debut in Brussels.

Award winners

One of the highlights of the Brussels Motor Show was the Car of the Year award. A panel of senior motoring journalists across 23 countries voted between seven new models. The winner was the Mercedes-Benz CLA, followed by the Skoda Elroq and Kia EV4.

Mercedes-Benz also held the world premiere of the GLB at the event. The SUV launched with two BEV variants that feature 800-volt technology and a WLTP range of up to 631km. The GLB also has vehicle-to-grid (V2G) and vehicle-to-home (V2H) charging capabilities. An entry-level model is planned, as well as a hybrid version.

Porsche revealed two European premieres, the Cayenne Electric and the Macan GTS. The former is the most powerful Porsche ever, reaching 0-100kph in 2.4 seconds.

Ford held the world premiere of its facelifted Ranger pick-up truck at the Brussels Motor Show. The brand’s BlueCruise’ hands-free autonomous driving feature has been added to the model. The updated Ranger is scheduled to begin deliveries in May 2026.

Meanwhile, Tesla hosted the European premiere of the Model 3 Standard. The BEV is the carmaker’s affordable model to date, with a WLTP range of 534km.

This content is brought to you by Autovista24.

Lukk

Lukk